THE PLAN FOR BUSINESS

West Atlantic Petroleum and Shipping Company Ltd. (WAPSCO) is a product of the experience of Oil industry professionals who saw the industry takeoff in Nigeria and whose career progressed from officer level to the highest professional, managerial and political levels in the industry.

The Vision of WAPSCO in initiating the petroleum products Depot and Open Sea Jetty project is to address the gap in supply infrastructure being inadequate product receiving capacity from import and even coastal refineries, inadequate commercial storage capacity across the country (no strategic storage at all) and inadequate Road Truck loading capacity at locations receiving the bulk of supplies from import. All these culminate into product out age, queues and confusion at fuel stations at the slightest interruption of supply.

This vision is therefore to be part of the sustainable solution to smooth and steady fuel supply to Nigeria and its neighbours. Its mission is to establish a reliable petroleum products supply and distribution network from its Lekki Depot location which is away from the congested and problematic first generation Apapa sea port in Lagos. Although stakes are high for the establishment of private refineries in Nigeria now that the market has been deregulated, issues of competition with European refineries, labour union crisis of decommissioning or privatization of government refineries and the ability of government to take that decision will make the country depend on import f or at least the next four to six years when public and private refineries may be economic to compete with import. However, in the event that development of the private refinery in the vicinity of WAPSCO’s location (Dangote refinery) is earlier than expected or when it eventually manifests, WAPSCO will need either additional pipeline investment to install a 25km pipeline to deliver products to Site or move products by loaded vessels or barges.

Vision:

“To become the best petroleum products Terminal Service Operator in Nigeria”

Mission:

“To establish a reliable petroleum products supply and distribution channel in Lekki to serve the Nigerian market”

Key objective:

“To establish presence in the Nigeria Downstream Oil industry by importing, buying, selling and distributing bulk petroleum products (PMS, DPK, AGO and LPG) by road trucks and coastal vessels in Nigeria and other parts of West and Central Africa from a Depot and Jetty built in LagosEast Atlantic Coast (Lekki), Nigeria”

Why Choose Us

“ Lanscrop company puts the prestige on the top, we always have cheap price and superior quality, a gardening company you can put absolute trust. ”

DEMAND FOR DEPOT AND JETTY SERVICES

Deriving from actual 2017 petroleum products supply statistics analyzed in this report, total jetty delivery was 53.27 million liters per day, and total jetty capacity nationwide to discharge 32,000 dwt cargos without transshipment was 45.2 million liters per day leaving a deficit of 8.36 million liters per day delivered by transshipment to smaller depots. This deficit is expected to increase to 23.63 million liters per day in 2023 when WAPSCO project becomes fully operational. Demand projection under this base case is conservative at 1.75%, the deficit may be as much as 30 million liters per day in 2025 if no new jetty project is in progress to add to handling capacity after WAPSCO project becomes operational.

OPEC in its analysis assumes consumption growth of petroleum clean products in Nigeria in this decade to be 12.5% while US state Department of Energy Information and Administration puts consumption growth in Nigeria in the decade to 4.5%. If an average of both forecasts is assumed to manifest under steady supply situation, then an average growth of 7.0%

growth in consumption will translate into facility expansion of 50.0 million liters per day for Jetty expansion and 28.2 million liters per day truck loading in 2023.

These figures do not include increase in daily jetty deliveries and truck loading to take care of the required stock build nationwide which in the current situation is less than seven (7) days. The 13.3 million liters per day Jetty and Truck loading capacity investment proposed by WAPSCO is only a percentage of expert’s expectation of capacity expansion required in Nigeria’s downstream industry.

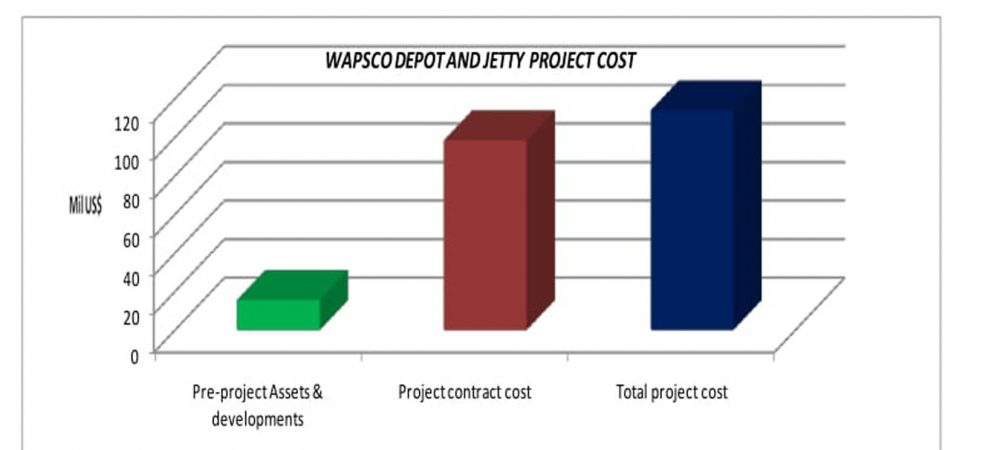

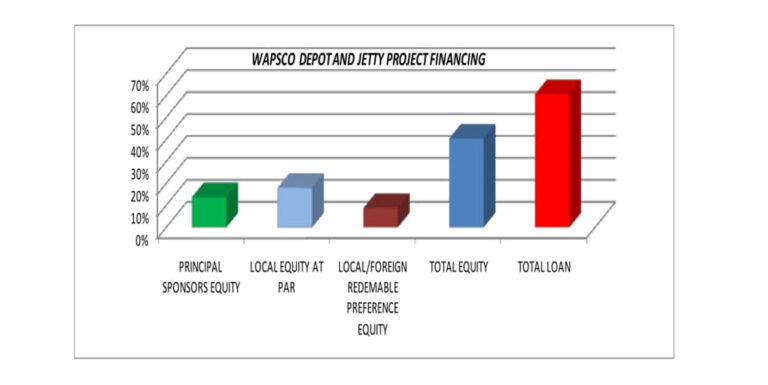

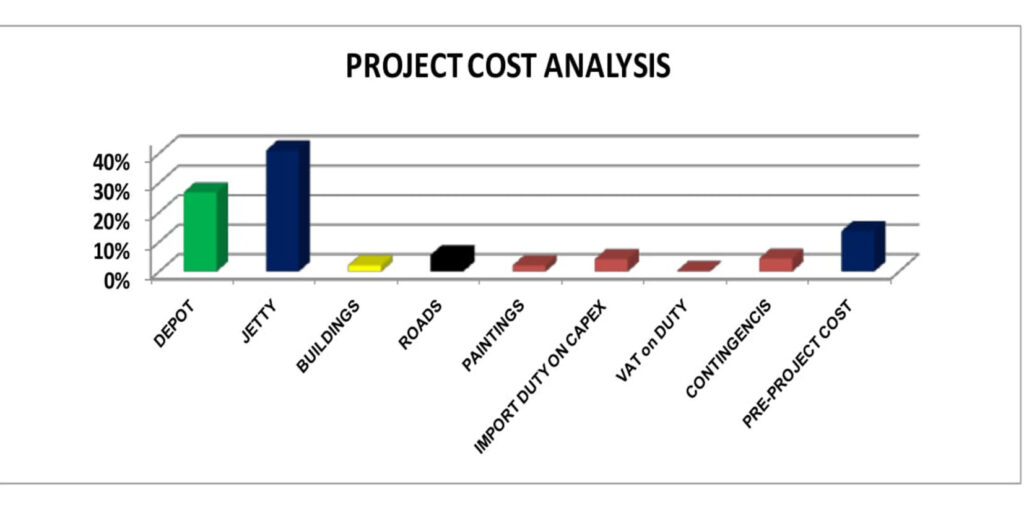

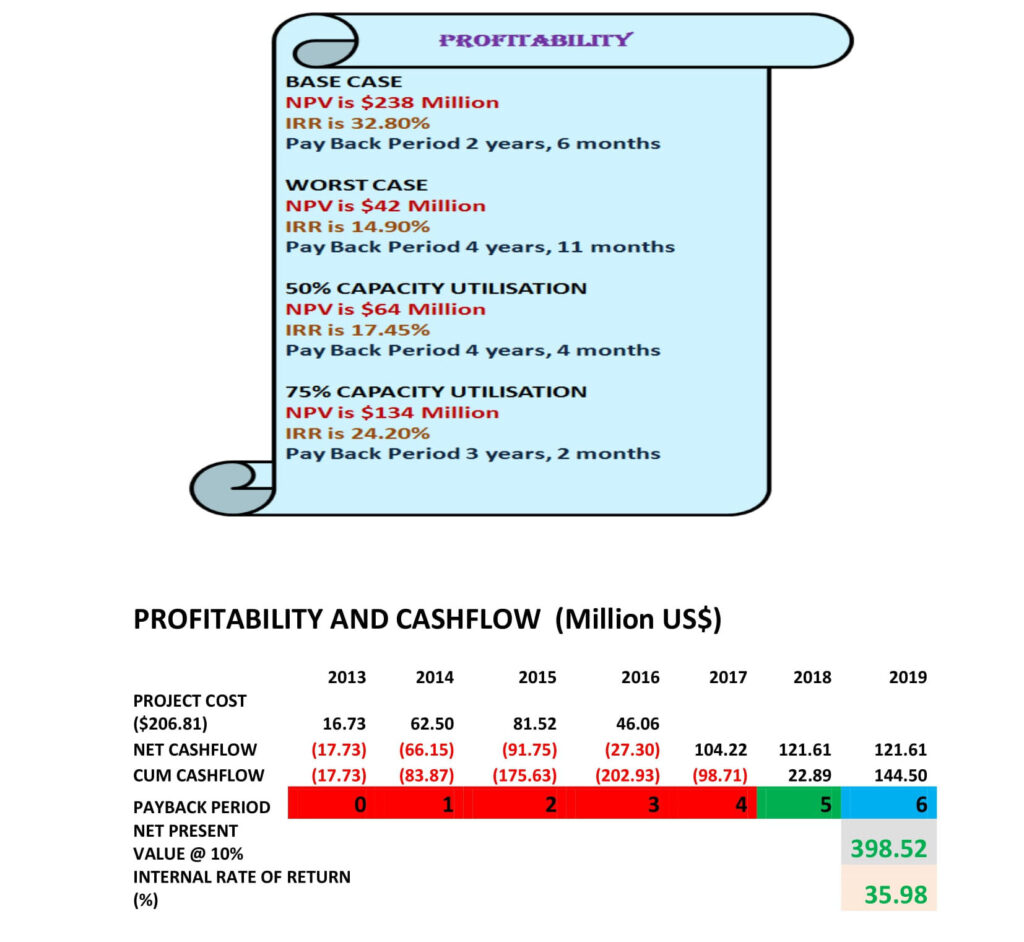

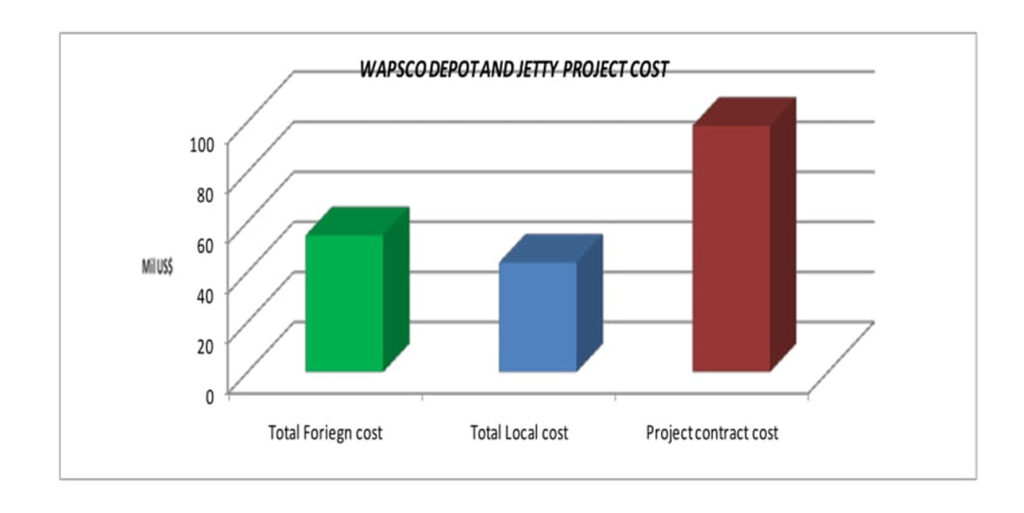

WAPSCO’S PROPOSED INVESTMENT

WAPSCO intends to build a petroleum products import Terminal with comprising a 38,000 DWT (max) unloading Jetty, to handle about three (3) 30,000 DWT vessels per week on the average and a 5,000 DWT (min) loading jetty to handle small parcel loading of coastal vessels. It shall also contain a tank farm/depot of about 145,000 cubic meters and ten (10) truck loading gantries for PMS, DPK and AGO at a total cost of about $113 million, 60% debt and 40% equity.

This translates to a total handling capacity of about thirteen (13) million liters per day. This is a fraction of the capacity gap established by the Feasibility study. Apapa port is congested, the best location for jetty capacity expansion is Lekki; the future industrial location of Lagos. This is the

strength of WAPSCO.

WAPSCO, INDUSTRY AND COMPETITION

WAPSCO’s target customers are the Nigerian National Petroleum Corporation which up till now imports the largest volume of products but cannot discharge and/or pump to its depots because of decay of facilities and vandalism of pipelines which miscreants attack often to steal products.

NNPC Retail Company services its fuel stations from supplies that it can get from sources different from NNPC. NNPC Retail has already given WAPSCO a non commi ttal letter of promise to use the facility when completed. Independent marketers, private depot owners with shallow jetties and Majors who do not have Jetty of their own are targeted for WAPSCO business.

There are currently only four (4) Jetties that can discharge full size import cargoes, two are owned by NNPC and two owned by private companies, these two do not have space to load more than 150 road trucks a day while WAPSCO is to be installed with 400 trucks per day maximum, this is a clear

advantage over competitors.

WAPSCO with its ability to discharge full size import cargoes has lower operating cost and higher margin over its

competitors. This can be seen on the industry Regulator’s Pricing Template in this report. WAPSCO can therefore use all the 3Ps (Price, Place and Promotion) of marketing to beat competitors in course of its operation.

WAPSCO’S BUSINESS ENVIRONMENT

The Downstream Sector of the Nigerian Petroleum Industry experienced a ground swell in May 2016 when Government removed subsidy completely from the three clean petroleum products; PMS, HHK and AGO). Apart from this major policy change, exchange rate of N298/US$ was also fixed for all

petroleum products official transactions. This was well above N198/US$ the then ruling rate of the Centra l Bank of Nigeria. This figure has since moved to N415/US$ since June 2021.

These regulatory changes along with scarcity of foreign exchange to back importation of products put supply business back exclusively into the hands of Government. Nigerian National Petroleum Corporation (NNPC) an agent of Government became the only supplier of products import into the country, private companies are left to deal with Distribution and Retail although Government later in the year floated the exchange rate which then applied same rate to all areas of the economy.

Development of infrastructure, including investment in new capacities slowed down considerably and compelled WAPSCO to review its product storage depot and Jetty project, identifying its impact on Project Cost, Financing, Schedule, Operation and Loan repayment.

While the impact of current economic development weighs moderately on Cost, Financing and Operation as the local market for fuel in the country’s

energy mix remains guaranteed and robust, its impact on the ability of the project to pay back foreign investors cannot be guaranteed.

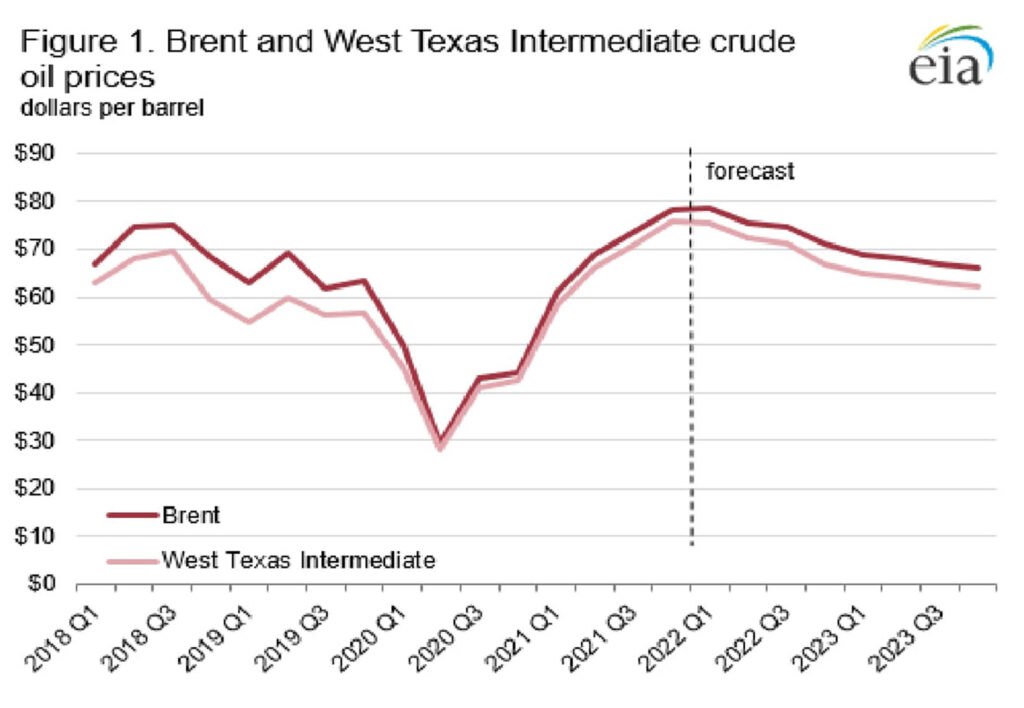

Further review of major factors of the economy namely; Government revenue from Oil and changes in regulation is made to see when these will favour availability of foreign exchange by the time WAPSCO’s project is completed and payment to foreign investors on the project can be made easily. Of these two factors, Oil revenue is key and a review of the international Oil market is necessary to model expected development in the medium term and how well Nigerian economy will perform beyond 2025 when the project shall be completed.

The International Oil Market

Although prices fell to their lowest levels in 2016, the oil market crash substantially took place in 2015 with 46.68% down from 2014 while it was only 18.10% further decline in 2016. It can be speculated here that the down turn in oil price began in 2014, it crashed in 2015 and dropped further to the bottom in the first quarter of 2016 while going through slow but steady recovery for the rest of the year. Opec’s

decision to cut supply at its end November 2016 pushed up market recovery beyond 2018.

Global economic development remains central to the overall outlook of the Oil market in the years ahead since the global recovery from covid-19 pandemic in the beginning of 2022. World economic growth in 2021 was 3.2% and is expected to rise to 3.5% in 2023. The forecast is for it to rise to 3.8% in 2024. Opec speculates that oil will remain dominant in the global energy mix over the next 25 years as it helps to satisfy the world’s growing energy needs.

The most important source of oil demand growth will be in developing countries where population continues to gro and many are expected to move out of poverty. However the oil industry will continue to be moderated by economic development, policy measures, technology and non-Opec supply.

Removal of subsidies, new upstream fiscal regimes, support for renewable energy and further energy efficiency targets are the important policy factors that will limit oil demand growth. Global economic growth is seen to be improving but at a

relatively slow rate, much below its potential.

Increase in world population, changes in demographic trend for more adult population and increase in migration from rural to urban population are factors that will favour increase in oil demand in the medium term. Economic Recovery On the Way For Nigeria So far oil price has been supportive having increased slowly but progressively in the year. Government has held on to its monetary and fiscal policies however, weaker naira and lower consumer spending have not made the impact of initiatives and performance of 2021 budget substantially manifest. Sustained

Environmentally Friendly

We use environmental friendly companies, such as zero waste printers for all our marketing material.

Professional Team

We understand that customer satisfaction starts with dependable service. With a dedicated and dedicated team.

Quickly And Efficiently

We always work quickly, but we pairing is great quality, we know how you look forward to your garden.

Our clients

In addition to the wishes of the client, the position, orientation, and size of the plot also play an important role in determining the final plan of the house. The 'where' and 'how' of the exterior then follows naturally from all of that.

We Love Lanscop!

“ When we were looking to install a rain garden due to a water drainage issue on our side yard, we were so fortunate to find Lanscop Garden Service on-line. Lauren responded to us promptly and was out to provide her professional opinion as to what was needed to solve our issue. She provided us with a tasteful and beautifully designed and effective solution to our drainage and erosion issues.”

Catrina Bonus

New York City

“ We were so fortunate to find Lanscop Garden Service on-line when we were looking to install a rain garden due to a water drainage issue on our side yard. Lauren responded to us promptly and was out to provide her professional opinion as to what was needed to solve our issue. She provided us with a tasteful and beautifully designed and effective solution to our drainage and erosion issues.”

Tom Holland

Manchester City

“ When we were looking to install a rain garden due to a water drainage issue on our side yard, we were so fortunate to find Lanscop Garden Service on-line. Lauren responded to us promptly and was out to provide her professional opinion as to what was needed to solve our issue. She provided us with a tasteful and beautifully designed and effective solution to our drainage and erosion issues.”

Noor Mallick

New York City

“ We were so fortunate to find Lanscop Garden Service on-line when we were looking to install a rain garden due to a water drainage issue on our side yard. Lauren responded to us promptly and was out to provide her professional opinion as to what was needed to solve our issue. She provided us with a tasteful and beautifully designed and effective solution to our drainage and erosion issues.”

Sam Khan

Birmingham

Working Process

Consultation

Before working, we always advise our customers

about the options for customers to refer

Design & Work

We will look into your garden and give you an idea

of how it will work

Complete & Maintenance

Your loved garden will be warranted by us within 1

year of completion